Title

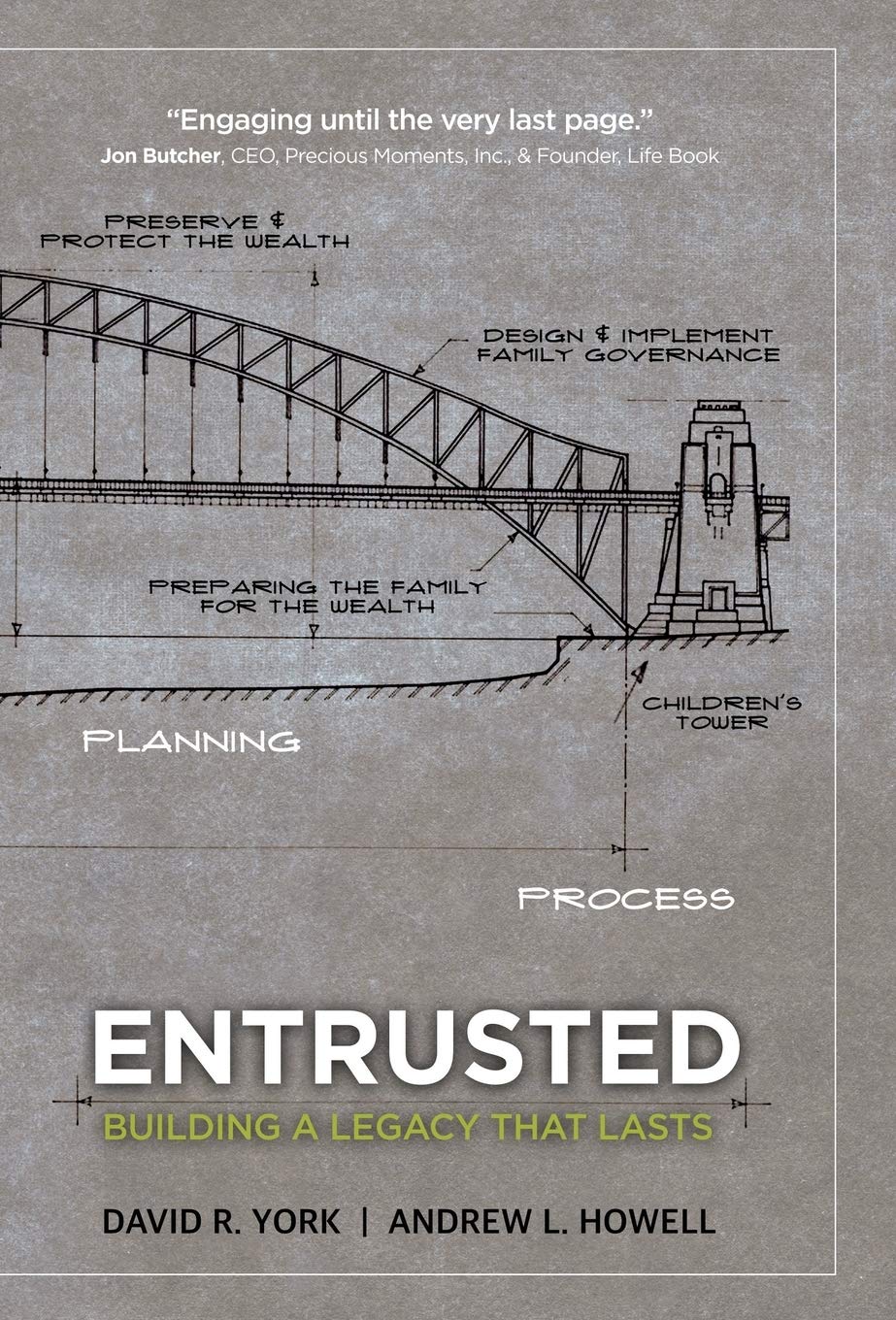

Entrusted: Building a Legacy That Lasts,New

Delivery time: 8-12 business days (International)

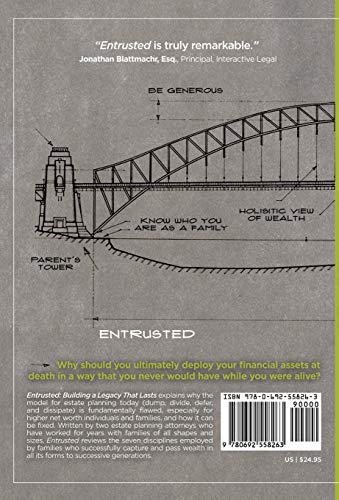

When it comes to estate planning and the effective transfer of wealth, most discussions involving the terms wealth and money use those terms interchangeably. Although the two are not the same, most estate planners today do not even broach this concept with their clients or include the lesstangible aspects of wealth as they draft an estate plan. They simply develop an estate plan that prepares the family's financial assets to be dumped, divided, deferred, and dissipated among the members of the next generation. These estate plans typically reflect a very linear way of thinking. In other words, if transferring some amount of financial wealth is good, then transferring more financial wealth is better. Not only is this approach is myopic and simplistic, but it's ultimately destructive because it focuses on the fire (the result) and not on the flint and kindling (the tools and resources that produce the result).Entrusted lays out the foundations of Entrusted Planning process, which aligns the principles and values of a family with their tangible assets and prepares future generations to build a true and lasting legacy. It's a process that draws from the very origins of estate law, which placed the highest value on who was involvedon who was entrusted. Entrusted Planning goes back to preparing beneficiaries for wealth beyond just the legal concept of a trust and takes into account the relational maturation of the person or persons being entrusted as stewards of resources, not just consumers and users of it. Entrusted Planning is about transferring opportunities instead of just assets and doing so over multiple generations.By focusing on the means to an end (education, personal character, home ownership, entrepreneurship, charitable service) as opposed to the end (stocks, bonds, real estate, and businesses), Entrusted Planning has the greatest potential to do the maximum amount of multigenerational good with the least amount of collateral damage. Entrusted families have goals that are both deep and broad. They're less interested in preparing their families to be rich and more interested in preparing them to manage, sustain, and carry on a rich legacy.Entrusted outlines seven core disciplines that can be found across a multitude of successful highnetworth families going back hundreds of years. These are not hypothetical or idealistic disciplines. These disciplines are real and permeate through the families who have embraced these concepts.Discipline 1. Entrusted families know who they are and what they believe.Discipline 2. Entrusted families prepare the family for the wealth and not just the wealth for the family.Discipline 3. Entrusted families maximize the positive benefits of wealth and minimize the negative effects.Discipline 4. Entrusted families focus on flint and kindling and not on the fire.Discipline 5. Entrusted families are generous.Discipline 6. Entrusted families preserve and protect wealth.Discipline 7. Entrusted families design and implement dynamic governance.When a family gets to the point where they are putting their wealth behind a statement such as 'We are the Smiths. This is what we believe in, this is what we value, and this is what we do to impact the world,' they will produce successive generations who can be Entrusted.

By changing our most important processes and

products, we have already made a big leap forward. This ranges from the

increased use of more sustainable fibers to the use of more

environmentally friendly printing processes to the development of

efficient waste management in our value chain.

⚠️ WARNING (California Proposition 65):

This product may contain chemicals known to the State of California to cause cancer, birth defects, or other reproductive harm.

For more information, please visit www.P65Warnings.ca.gov.

Shipping & Returns

Shipping

We ship your order within 2–3 business days for USA deliveries and 5–8 business days for international shipments. Once your package has been dispatched from our warehouse, you'll receive an email confirmation with a tracking number, allowing you to track the status of your delivery.

Returns

To facilitate a smooth return process, a Return Authorization (RA) Number is required for all returns. Returns without a valid RA number will be declined and may incur additional fees. You can request an RA number within 15 days of the original delivery date. For more details, please refer to our Return & Refund Policy page.

Shipping & Returns

Shipping

We ship your order within 2–3 business days for USA deliveries and 5–8 business days for international shipments. Once your package has been dispatched from our warehouse, you'll receive an email confirmation with a tracking number, allowing you to track the status of your delivery.

Returns

To facilitate a smooth return process, a Return Authorization (RA) Number is required for all returns. Returns without a valid RA number will be declined and may incur additional fees. You can request an RA number within 15 days of the original delivery date. For more details, please refer to our Return & Refund Policy page.

Warranty

We provide a 2-year limited warranty, from the date of purchase for all our products.

If you believe you have received a defective product, or are experiencing any problems with your product, please contact us.

This warranty strictly does not cover damages that arose from negligence, misuse, wear and tear, or not in accordance with product instructions (dropping the product, etc.).

Warranty

We provide a 2-year limited warranty, from the date of purchase for all our products.

If you believe you have received a defective product, or are experiencing any problems with your product, please contact us.

This warranty strictly does not cover damages that arose from negligence, misuse, wear and tear, or not in accordance with product instructions (dropping the product, etc.).

Secure Payment

Your payment information is processed securely. We do not store credit card details nor have access to your credit card information.

We accept payments with :

Visa, MasterCard, American Express, Paypal, Shopify Payments, Shop Pay and more.

Secure Payment

Your payment information is processed securely. We do not store credit card details nor have access to your credit card information.

We accept payments with :

Visa, MasterCard, American Express, Paypal, Shopify Payments, Shop Pay and more.

Related Products

You may also like

Frequently Asked Questions

- Q: What is the main focus of 'Entrusted: Building a Legacy That Lasts'? A: The book focuses on the Entrusted Planning process, which emphasizes aligning a family's values and principles with their tangible assets to create a lasting legacy across generations.

- Q: Who is the author of this book? A: The author of 'Entrusted: Building a Legacy That Lasts' is Andrew L. Howell.

- Q: What are the key disciplines outlined in the book? A: The book outlines seven core disciplines that successful high-net-worth families practice, including knowing their identity and values, preparing the family for wealth, maximizing the benefits of wealth, and designing dynamic governance.

- Q: What type of binding does this book have? A: This book is available in hardcover binding.

- Q: How many pages does 'Entrusted: Building a Legacy That Lasts' have? A: The book contains 236 pages.

- Q: When was this book published? A: The book was published on November 1, 2015.

- Q: What is the condition of the book? A: The book is listed as new.

- Q: What category does this book fall under? A: The book falls under the category of Personal Finance.

- Q: What is the main message of Entrusted Planning? A: The main message is to focus on transferring opportunities rather than just assets, preparing future generations to manage and sustain a rich legacy.

- Q: Is this book suitable for families looking to improve their estate planning? A: Yes, this book is suitable for families seeking to enhance their estate planning by focusing on values, education, and personal development alongside financial assets.