Title

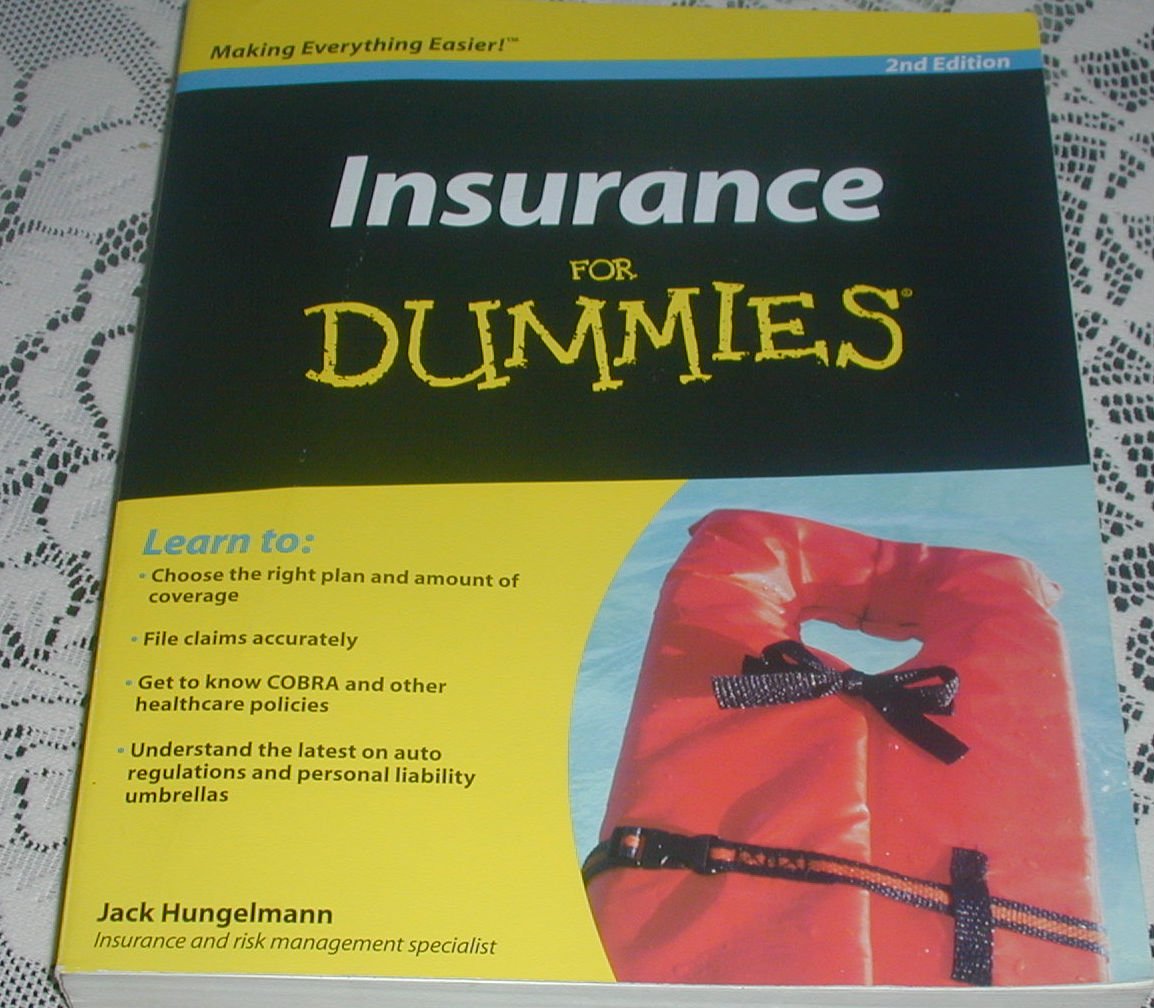

Insurance for Dummies,New

Processing time: 1-3 days

US Orders Ships in: 3-5 days

International Orders Ships in: 8-12 days

Return Policy: 15-days return on defective items

Now updated your guide to getting the best insurance policyAre you intimidated by insurance? Have no fear this easytounderstand guide explains everything you need to know, from getting the most coverage at the best price to dealing with adjusters, filing claims, and more. Whether you're looking for personal or business insurance, you'll see how to avoid common pitfalls, lower your costs, and get what you deserve at claim time. Get to know the basics understand how to make good insurance decisions and reduce the chances of a financial loss in your lifeTake your insurance on the road manage your personal automobile risks, handle special situations, insure recreational vehicles, and deal with insurance adjustersUnderstand homeowner's and renter's insurance know what is and isn't covered by typical policies, common exclusions and pitfalls, and how to cover yourself against personal lawsuitsBuy the right umbrella policy discover the advantages, and coordinate your policies to cover the gapsManage life, health, and disability risks explore individual and group policies, understand Medicare basics, and evaluate longterm disability and longtermcare insuranceOpen the book and find: The best life, health, home, and auto policiesStrategies for handling the claims process to get what you deserveTips on adjusting your deductible to suit your lifestyleHow to navigate healthcare policiesWays to reduce your risk and your premiumsCommon traps and loopholesConsiderations for grads, freelancers, and remote workers

⚠️ WARNING (California Proposition 65):

This product may contain chemicals known to the State of California to cause cancer, birth defects, or other reproductive harm.

For more information, please visit www.P65Warnings.ca.gov.

- Q: What topics does 'Insurance for Dummies' cover? A: 'Insurance for Dummies' covers a wide range of topics including personal and business insurance, car insurance, homeowner's and renter's insurance, life and health insurance, disability risks, and tips for navigating the claims process.

- Q: Who is the author of 'Insurance for Dummies'? A: The author of 'Insurance for Dummies' is Jack Hungelmann, who provides insights and practical advice on various types of insurance.

- Q: Is this book suitable for beginners? A: 'Insurance for Dummies' is designed to be easy to understand and is ideal for beginners who may feel intimidated by insurance concepts.

- Q: How many pages does 'Insurance for Dummies' have? A: 'Insurance for Dummies' has a total of 384 pages, providing comprehensive information on insurance topics.

- Q: What is the binding type of this book? A: 'Insurance for Dummies' is available in a paperback binding, making it easy to handle and read.

- Q: When was 'Insurance for Dummies' published? A: 'Insurance for Dummies' was published on June 9, 2009, and has been updated to reflect current insurance practices.

- Q: What are the key features of this book? A: 'Insurance for Dummies' includes strategies for managing insurance claims, tips on adjusting deductibles, and insights on reducing risks and premiums.

- Q: Can this book help with understanding auto insurance? A: 'Insurance for Dummies' offers guidance on managing personal automobile risks, including how to handle special situations and work with insurance adjusters.

- Q: Does the book provide information on life and health insurance? A: 'Insurance for Dummies' explores individual and group life, health, and disability insurance, including Medicare basics.

- Q: What edition of 'Insurance for Dummies' is available? A: 'Insurance for Dummies' is currently available in its second edition, which includes updated information and strategies.