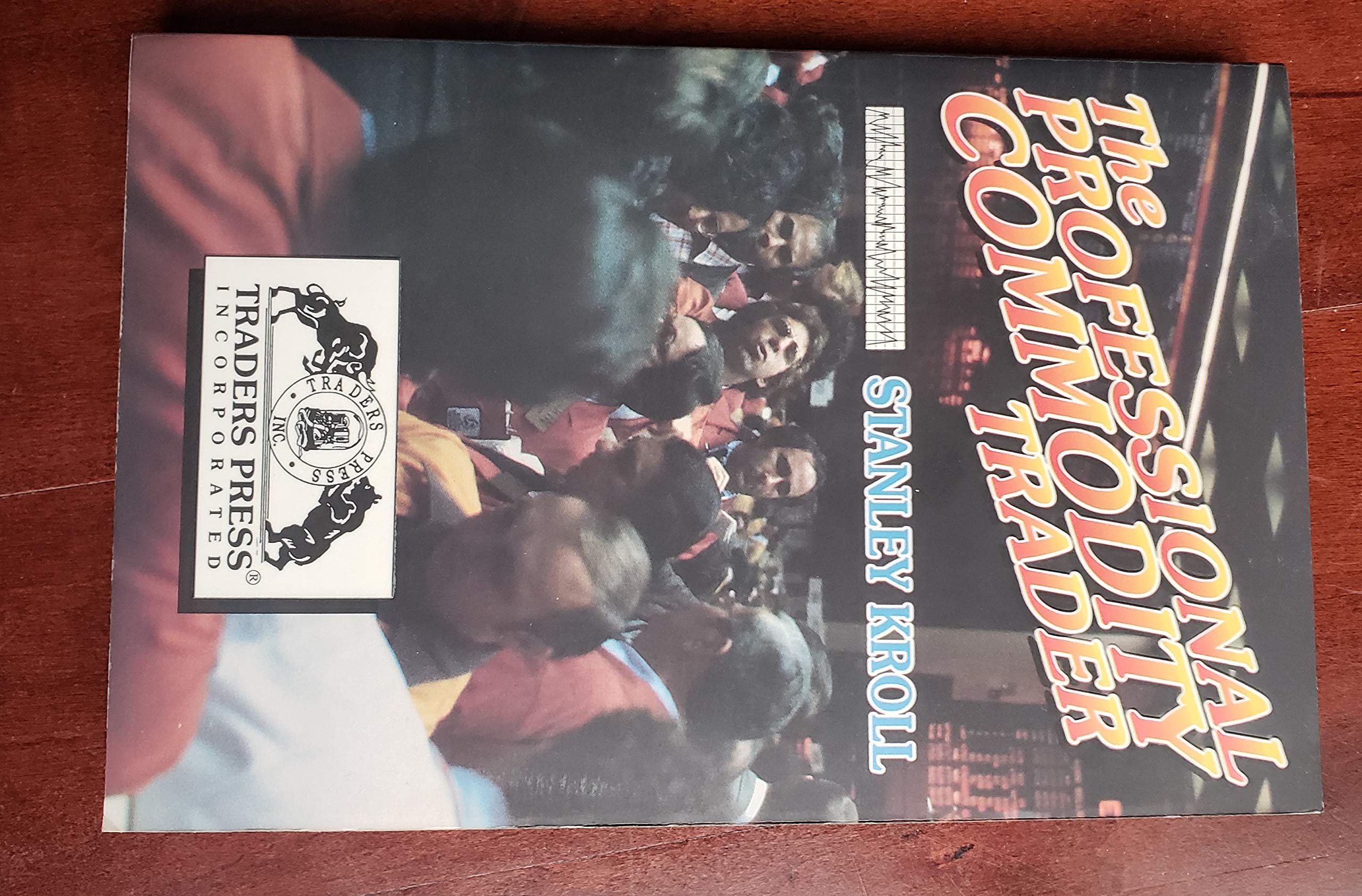

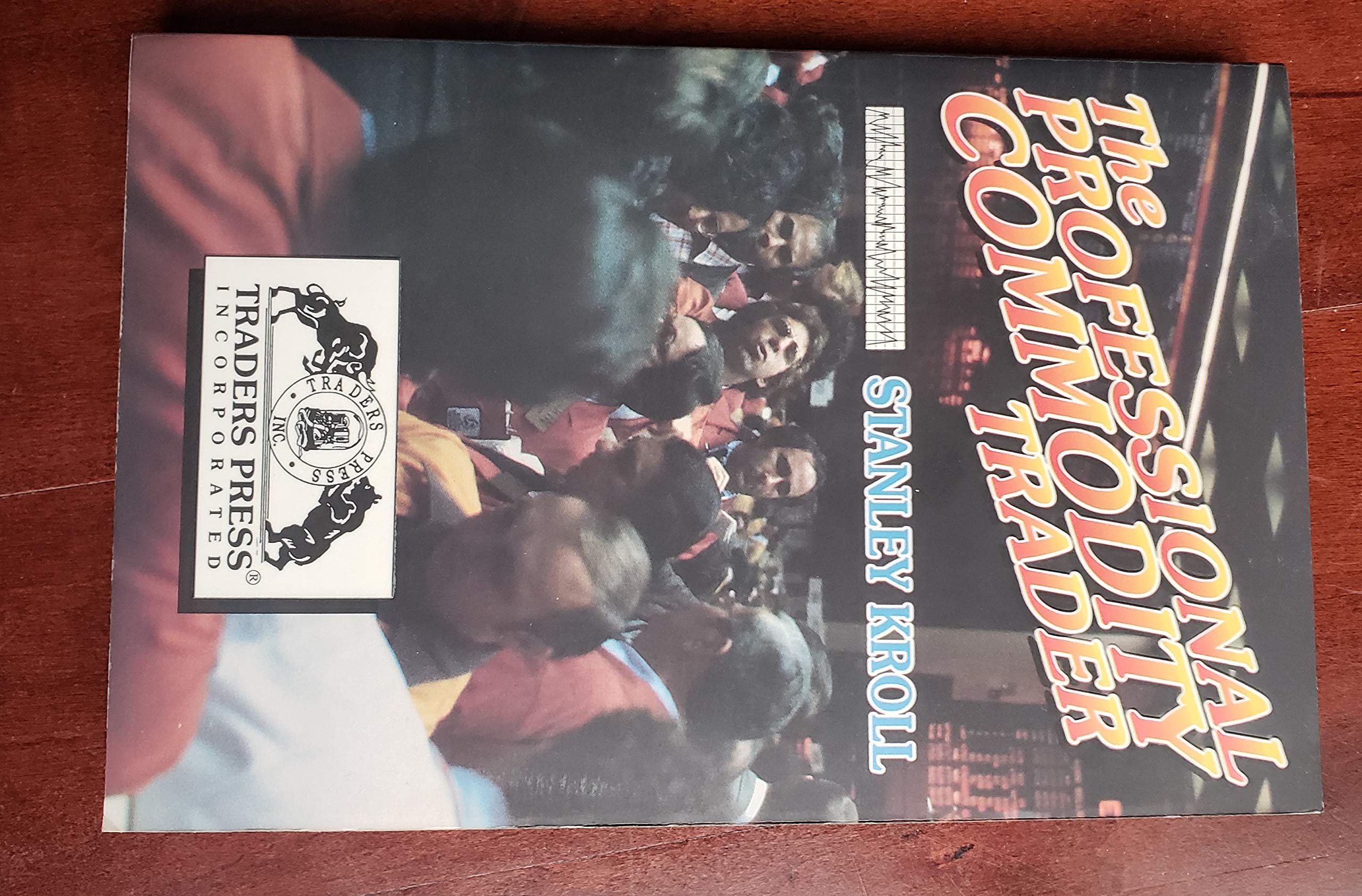

Title

The Professional Commodity Trader,Used

Processing time: 1-3 days

US Orders Ships in: 3-5 days

International Orders Ships in: 8-12 days

Return Policy: 15-days return on defective items

Reprint Of 1973 Classic In Which Legendary Futures Trader Stanley Kroll Describes His Trading Adventures And Discusses Philosophy.It Is A First Person Lookovermyshoulder Account Of His Trading Campaigns During The Wild And Woolly Markets Of 1973, And A Close Look Into His Trading Philosophy And Techniques.Kroll'S Primary Focus Is On Trading Only With The Major Long Term Trend, And He Favors Entering Trades Only During Significant Reactions Against The Trend, And Holding Positions Until Either His Long Term Price Objectives Are Met, His Protective Stop Loss Level Is Violated, Or It Becomes Apparent That The Primary Trend Has Changed Direction.The Book Is Filled With Charted Examples Of Kroll'S Actual Trades In Various Markets. He Discusses At Length The Reasoning And Timing Behind The Decisions Involved In Entering, Adding To And Liquidating Each Position. Most Positions Were Idle For Weeks Or Even Months, Which Will Be Hard To Imagine For Today'S Quick In And Out Day Trader.Kroll Quotes Throughout From The Classic Reminiscences Of A Stock Operator, Which Chronicles The Trading Experiences And Philosophy Of Immortal Speculator Jesse Livermore. The Key Sections To Which Kroll Refers Are Those In Which Livermore Advises That The Big Money Is In The Big Move, And That His Biggest Profits Were Made Simply By Sitting Tight. Kroll Kept A Copy Of Reminiscences At His Desk At All Times For Inspiration, Whenever He Felt Tempted To Exit A Profitable Position Prematurely Or To Try Scalping The Market For Small Moves.Of Special Interest Is The Time Period Under Study (1973) Which Was The Wildest And Most Unforgettable Year In Memory. That'S The Year In Which Beans Went From 400 To 1290 And Back Down To 500, Wheat Went From 140 To 645, And Other Markets Made Huge Moves As Well. While Kroll Grabbed The Bull By The Horns And Realized Huge Profits In These Runaway Bull Markets, Others Cringed In Fear And Withdrew From Trading, Petrified By The Risk Inherent In Huge Moves Consisting Of Strings Of Lockedlimit Days In Both Directions.Kroll'S Narrative Is Made Credible By The Inclusion Of A Summary Detailing The Track Record Of 38 Individual Accounts Which He Managed During The 197173 Time Period, Which Shows 37 Of The 38 With Net Profits, With Most Showing Annualized Returns Well In Excess Of 200 Percent. The One Loser Lost Less Than 2 Percent. In The Aggregate, About $600M Of Capital Was Parlayed Into Almost $3 Million During This Period.The Professional Commodity Trader Is Fascinating Reading For Futures Traders Interested In Formulating A Viable, Long Term Approach.

⚠️ WARNING (California Proposition 65):

This product may contain chemicals known to the State of California to cause cancer, birth defects, or other reproductive harm.

For more information, please visit www.P65Warnings.ca.gov.

- Q: How many pages does 'The Professional Commodity Trader' have? A: The book has one hundred eighty-one pages. This length provides a comprehensive insight into the trading philosophy of Stanley Kroll.

- Q: What is the binding type of this book? A: The binding type is paperback. This makes it lightweight and easy to handle for reading.

- Q: Who is the author of 'The Professional Commodity Trader'? A: The author is Stanley Kroll. He is a legendary futures trader known for his trading techniques and philosophy.

- Q: How should I approach reading 'The Professional Commodity Trader'? A: You should read it in a quiet, focused environment. This book offers deep insights that may require careful consideration.

- Q: Is this book suitable for beginners in trading? A: Yes, it is suitable for beginners. However, some concepts may be more beneficial for those with a basic understanding of trading.

- Q: What is the main focus of the trading philosophy in this book? A: The main focus is on trading with the major long-term trend. Kroll emphasizes entering trades during significant reactions against the trend.

- Q: How can I maintain the condition of this used book? A: To maintain its condition, keep it in a dry, cool place and avoid exposure to direct sunlight. Handle it carefully to prevent wear.

- Q: Are there any notable quotes included in the book? A: Yes, Kroll includes quotes from 'Reminiscences of a Stock Operator.' These quotes illustrate key trading philosophies from Jesse Livermore.

- Q: What kind of trading strategies does Kroll discuss? A: Kroll discusses long-term trend trading strategies, including entering positions during market reactions and setting protective stop-loss levels.

- Q: Can I find real trade examples in this book? A: Yes, the book contains charted examples of Kroll's actual trades. These examples provide practical insights into his trading decisions.

- Q: Is there a summary of Kroll's trading accounts in the book? A: Yes, the book includes a summary detailing the track record of thirty-eight individual accounts managed by Kroll.

- Q: What years does the book focus on for trading analysis? A: The book focuses on the years nineteen seventy-one to nineteen seventy-three. This was a particularly volatile period in the markets.

- Q: Is 'The Professional Commodity Trader' considered a classic in trading literature? A: Yes, it is considered a classic. The book was originally published in nineteen seventy-three and remains relevant today.

- Q: What genre does 'The Professional Commodity Trader' belong to? A: The book belongs to the genre of finance and investing. It specifically focuses on commodity trading.

- Q: What is the main takeaway from Kroll's trading experiences? A: The main takeaway is that significant profits come from holding positions during major market moves, rather than frequent trading.